An Unbiased View of Estate Planning Attorney

An Unbiased View of Estate Planning Attorney

Blog Article

Unknown Facts About Estate Planning Attorney

Table of ContentsOur Estate Planning Attorney StatementsWhat Does Estate Planning Attorney Do?The Main Principles Of Estate Planning Attorney Estate Planning Attorney Fundamentals Explained

Finding a probate lawyer who's acquainted with a court's preferences can make the procedure a great deal smoother. "Just how long do you estimate my instance will take before the estate will be cleared up?

A percentage based on the estate worth? Whether or not to work with a probate attorney depends on a range of components. You desire to consider exactly how comfy you are browsing probate, how challenging your state regulations are and how big or substantial the estate itself is.

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Those situations can be avoided when you're properly shielded. The good news is, Trust Fund & Will is below to assist with any and all of your estate intending demands.

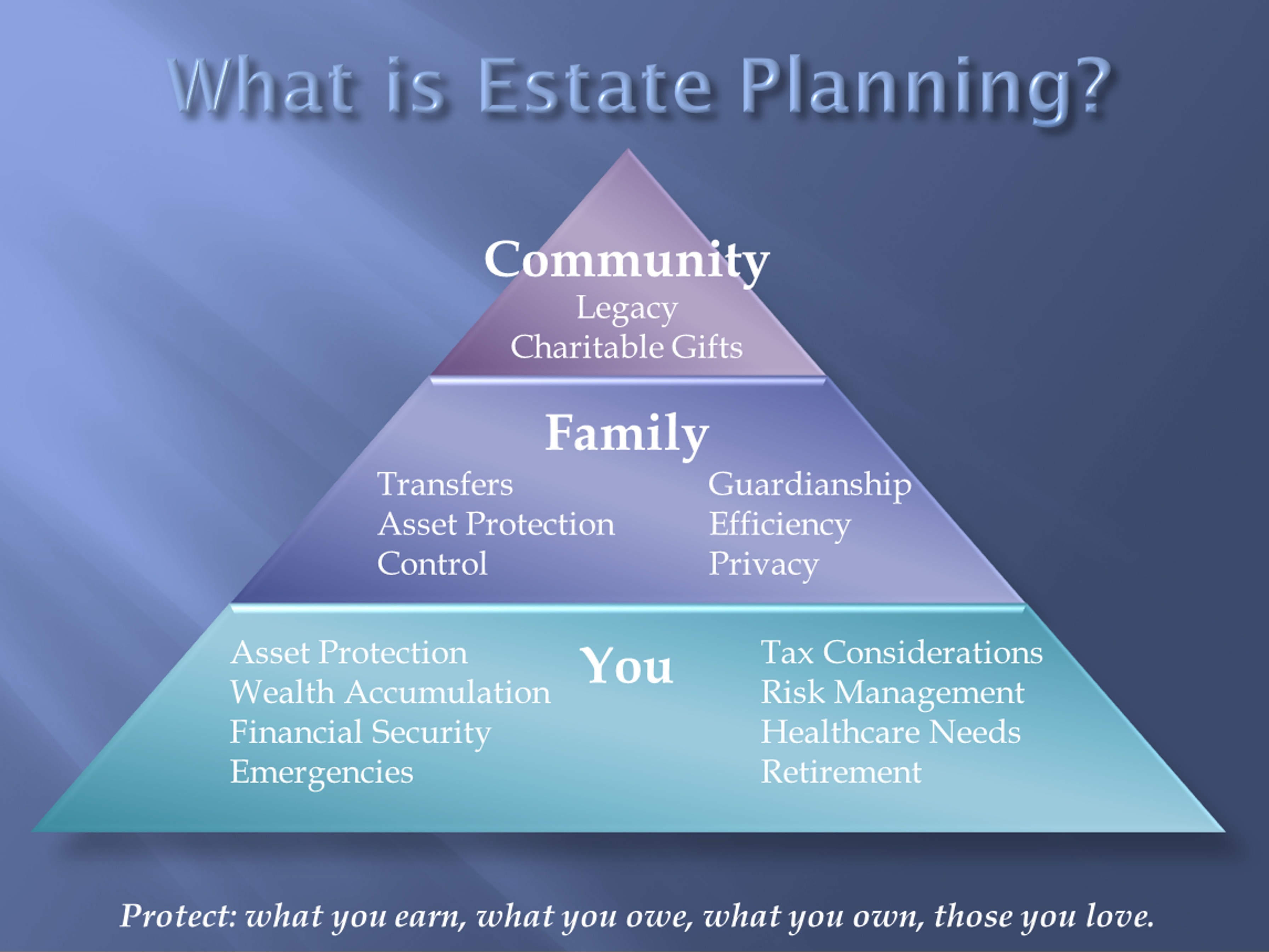

Strategies for estates can develop. Adjustments in possessions, health, separation, and also moving out of state needs to all be represented when updating your estate strategy. A count on lawyer can assist to upgrade your depend on terms as appropriate. The lawyers will address depend on conflicts, manage distributions and shield your aspirations and desires even long after your fatality.

These trusts are beneficial for a person who is either young or financially untrustworthy. : Establishing up a QTIP (Qualified Terminable Passion Residential property Trust) will certainly ensure that revenue from the Trust would certainly be paid to your surviving partner if you pass away. The staying funds would be held in the initial Count on, and after the partner dies, the cash mosts likely to your beneficiaries.

Rumored Buzz on Estate Planning Attorney

Your assets are passed over to your grandchildren, which indicates they are absolved from inheritance tax that might have been activated if the inheritance mosted likely visit here to your children. Listed here are methods which a trust fund can make your estate intending a significant success.: Probate is typically also time-consuming and usually takes a year or more to complete.

Attorney fees and court costs can account for as long as 5 % of the value of an estate. Counts on can assist you check that to settle your estate rapidly and effectively. Possessions in a count on are invested under the principles of Prudent Investment-these can allow them to expand greatly currently and after your fatality.

The probate procedure is public. Therefore, once your estate is presented for probate, your will, company, and financial information come to be public document, subjecting your liked ones to haters, scammers, thieves, and destructive district attorneys. The personal and private nature of a count on is the opposite.: A trust protects your properties from claims, creditors, divorce, and other impossible difficulties.

Unknown Facts About Estate Planning Attorney

As safeguarding the passions of a minor child, a depend on can establish guidelines for distribution. In addition, it guarantees that you remain qualified for Medicare advantages.

An independent trustee can be selected if you believe your beneficiaries might not manage their possessions carefully - Estate Planning Attorney. You can likewise set use limitations. It might specify in the Count on that possession circulations might just be made to recipients for their well-being needs, such as buying a home or paying medical bills and not for fancy cars and trucks.

The is the procedure of choosing about what happens to you, your when you can no longer decide on your own. Your estate plan should include input from many individuals. If it does not, it might disappoint your expectations and be inefficient at meeting your goals. Let's look at the roles of individuals entailed in estate preparation Once the crucial thing residential property making plans files are established- their explanation which contain a it's much crucial to define the jobs and duties of the individuals called to serve in the ones files.

Performing a Will can be really time-consuming and calls for choosing somebody you trust to deal with the duty's obligation. According to their standard operating treatment guidelines, the court will certainly appoint a manager for your estate if you do not have a Will.

Report this page